Most B2B SaaS founders hit $1M ARR by sheer force of will: scrappy sales motions, founder-led deals, and a product that solves a real problem. But scaling from $1M to $25M? That’s where the wheels come off.

Your early GTM playbook: the one that got you here: becomes your biggest liability. Sales cycles slow down. CAC creeps up. Your team can’t agree on who the ideal customer actually is. Marketing and sales blame each other for pipeline gaps. And your CRM? It’s a graveyard of bad data and manual workarounds.

The revenue engine that powered your early growth starts to sputter. Not because your product isn’t good enough, but because you’re trying to scale a system that was never designed to scale.

Here’s the truth: getting from $1M to $25M ARR requires a fundamentally different approach to go-to-market strategy. You need predictable, repeatable systems that can handle complexity without breaking. You need alignment across every revenue function. And you need a blueprint that’s built for the chaos of hypergrowth.

Why Most Revenue Engines Break Between $1M and $25M

The $1M to $25M journey isn’t just about doing more of what worked early on. It’s a complete operational shift that most founders underestimate.

At $1M ARR, you’re probably closing 10-20 deals a year. Your founder or early sales hire knows every prospect personally. You’re iterating on messaging in real-time. Customer success is handled through Slack DMs and phone calls.

By $25M ARR, you need to close 200-500 deals annually: with a team of 30-50 people who’ve never met your first customers. Your ICP has evolved. You’re selling into multiple buyer personas across different departments. And those scrappy processes? They’ve become organizational debt that’s costing you millions in inefficiency.

The breakdown happens in three places:

Misaligned GTM motions. Sales is running an outbound playbook while marketing builds for inbound. Product builds features for one segment while sales chases another. Nobody’s working from the same revenue map.

Operational fragmentation. Your CRM is a mess. Attribution is a black box. Nobody knows which campaigns actually drive pipeline. Sales and marketing have different definitions of a qualified lead. RevOps doesn’t exist yet: or if it does, it’s just CRM administration.

Scaling the wrong things. You hire more sales reps before fixing your sales process. You increase ad spend before clarifying your ICP. You build more features before understanding why customers actually buy.

The result? Longer sales cycles. Higher churn. Unpredictable revenue. And a team that’s working harder but generating less leverage.

The Growth Engine 90 Framework: Your Scaling Blueprint

At Impactus Growth Advisors, we’ve worked with dozens of B2B SaaS companies navigating this exact inflection point. The pattern is always the same: companies that scale successfully build three integrated systems before they scale headcount.

We call it the Growth Engine 90 framework: a 90-day sprint to build the foundational systems that enable predictable, repeatable revenue growth.

It’s built on three pillars:

1. GTM Blueprint: Defining Your Revenue Map

Your GTM Blueprint is the strategic foundation: the single source of truth that aligns every revenue function around the same goals, ICP, and execution plan.

This isn’t a marketing plan or a sales deck. It’s a comprehensive revenue strategy that answers:

- Who are we selling to? (Segmented ICP with firmographic, technographic, and behavioral criteria)

- What value do we deliver to each buyer persona?

- How do we reach them? (Channel strategy, motion design, and buyer journey orchestration)

- Why do they buy? (Positioning, competitive differentiation, and urgency triggers)

- When do we engage? (Stage-aware messaging and multi-touch attribution)

The GTM Blueprint becomes your operating manual. Every hire, every campaign, every feature prioritization decision gets filtered through it. When sales and marketing disagree on targeting, the Blueprint settles it. When product wants to build for a new segment, the Blueprint provides the framework for evaluation.

Tactical implementation: Start with your top 20% of customers by LTV. Map their common attributes, pain points, buying committees, and adoption patterns. Then reverse-engineer a scalable acquisition and expansion playbook that targets more companies that look like them.

2. CRM/RevOps Optimization: Building Your Operational Backbone

Most founders treat their CRM as a place to store contact information. That’s like using a Ferrari to deliver groceries.

Your CRM: when properly architected: becomes your single source of truth for pipeline health, forecast accuracy, and revenue performance. It’s the operational backbone that lets you scale without chaos.

CRM/RevOps optimization means:

Data architecture that reflects your actual revenue process. Custom objects for your specific deal complexity. Lifecycle stages that map to buyer behavior, not internal handoffs. Fields that capture the metrics you actually manage to.

Automation that eliminates manual work. Lead routing based on fit and intent. Nurture sequences triggered by behavior. Pipeline alerts when deals stall. Forecasting that rolls up automatically.

Visibility that drives accountability. Real-time dashboards for every revenue leader. Attribution reporting that shows what’s actually working. Cohort analysis that predicts churn before it happens.

At this stage, you’re not just implementing HubSpot or Salesforce: you’re building a revenue operations system that scales with your business.

Tactical implementation: Audit your current CRM against your actual sales process. Identify gaps where data lives in spreadsheets, Slack, or people’s heads. Build a 30-day roadmap to systematize the top 3 friction points that slow deals down.

3. Demand Gen Launch: Filling the Pipeline with Qualified Opportunities

You can’t scale what you can’t measure. And you can’t measure what you haven’t systematized.

The Demand Gen Launch pillar is about building a multi-channel acquisition engine that generates qualified pipeline predictably: not through guesswork or sporadic campaigns, but through a systematic approach to reaching your ICP where they actually spend time.

This means:

ICP-first channel selection. If your buyers are on LinkedIn but you’re investing in SEO, you’re burning cash. If they respond to referrals but you’re running cold email, you’re wasting time. Match your channels to your buyer behavior.

Full-funnel campaign architecture. Awareness content that educates your market. Consideration assets that demonstrate your differentiation. Decision-stage resources that close deals. Each stage needs different content, different channels, and different success metrics.

Attribution and optimization. Multi-touch attribution that shows the real customer journey. A/B testing culture that compounds learning. Regular pipeline reviews that adjust spending based on what’s actually working.

Tactical implementation: Pick two channels where your best customers were originally sourced. Double down with a 60-day sprint: 10 pieces of content, $10K in budget, and clear pipeline targets. Measure everything. Kill what doesn’t work. Scale what does.

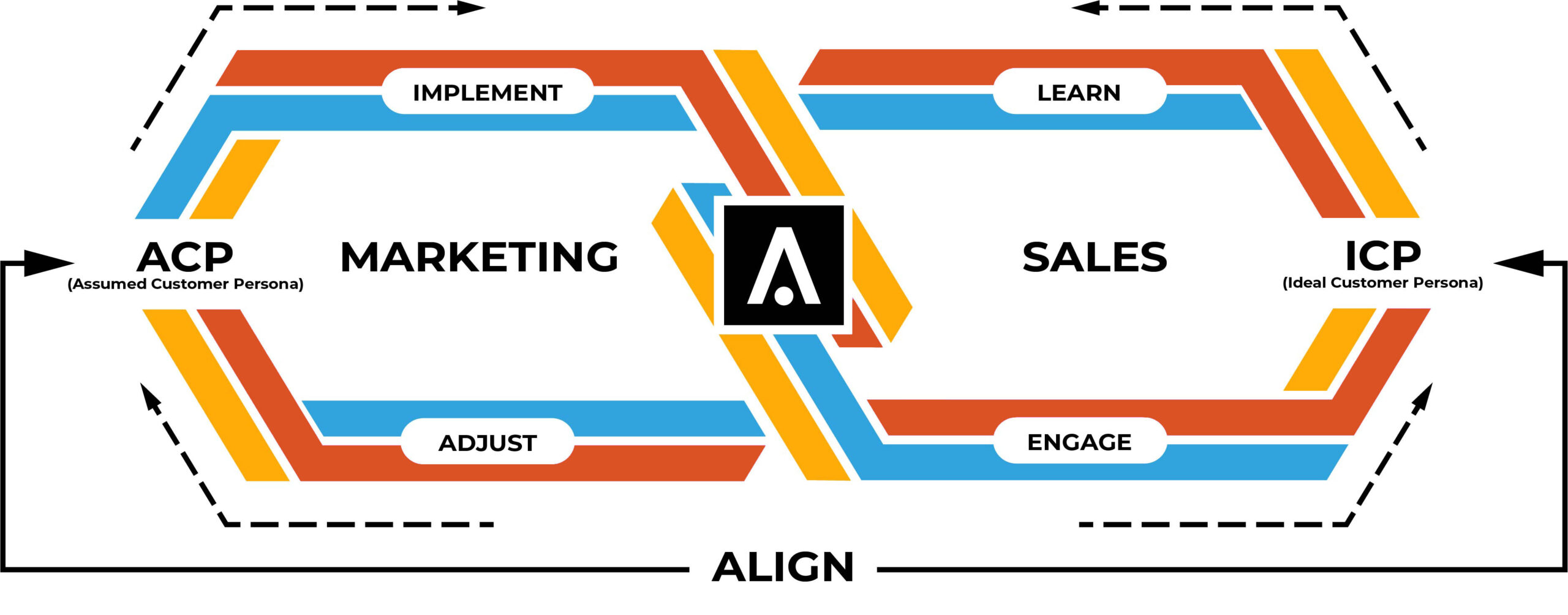

The Infinity Revenue Lifecycle: Why Linear Funnels Break at Scale

Here’s where most B2B SaaS growth consulting gets it wrong: they treat revenue like a linear funnel.

Lead → MQL → SQL → Opportunity → Customer → End.

But that’s not how B2B SaaS works: especially as you scale. Your best customers don’t move through a funnel. They move through a lifecycle. They engage, disengage, re-engage. They expand, contract, expand again. They churn and come back. They refer others who enter at different stages.

We call this the Infinity Revenue Lifecycle: the recognition that every customer touchpoint is both an endpoint and a new beginning.

When you design your GTM strategy around the Infinity Revenue Lifecycle, you:

- Build expansion revenue into your core model, not as an afterthought

- Create re-engagement campaigns for dormant users before they churn

- Treat customer success as a revenue function, not a cost center

- Capture referrals systematically, not accidentally

- Design product experiences that drive virality within accounts

At scale, expansion and retention become bigger levers than new acquisition. Companies with strong lifecycle motions grow 40% faster with 30% lower CAC than those still optimizing top-of-funnel alone.

Your 90-Day Roadmap to Unbreakable Growth

You don’t need to rebuild everything overnight. You need to systematically strengthen the three systems that matter most.

Days 1-30: GTM Blueprint

- Document your current ICP with actual data, not assumptions

- Map the buying committee and journey for your top 10 deals

- Align sales, marketing, and product on one prioritized target segment

- Build your positioning and messaging framework

Days 31-60: CRM/RevOps Optimization

- Audit your CRM data quality and process gaps

- Implement lead scoring and pipeline stage definitions

- Build your core reporting dashboards and forecasting model

- Automate the top 3 manual tasks slowing down your team

Days 61-90: Demand Gen Launch

- Launch your first full-funnel campaign to the prioritized ICP

- Implement multi-touch attribution

- Run pipeline reviews weekly and optimize based on data

- Scale what’s working, kill what’s not

This isn’t theory. It’s the exact playbook we run with B2B SaaS companies scaling from $1M to $25M ARR: and the companies that execute it hit their growth targets 3X more often than those who wing it.

Ready to scale without breaking? The Growth Engine 90 framework gives you the blueprint, systems, and execution support to hit $25M ARR with predictable, repeatable revenue.

Let’s talk about your growth goals.