You're burning $30K a month on ads. Sales is drowning in demos. Marketing claims the pipeline is full. Yet revenue is flat, win rates are dropping, and your CFO is asking hard questions about CAC payback.

The problem isn't effort. It's fit.

Most SaaS companies at $1M-$25M ARR don't have a demand generation problem, they have an ICP alignment problem. Your go-to-market engine is optimized to generate volume, not revenue. And every bad-fit lead that enters your funnel costs you time, money, and forecast accuracy.

Here's the proven GTM blueprint we use with clients to eliminate waste, tighten segmentation, and build a predictable revenue engine.

The Three ICP Mistakes That Kill Your GTM Efficiency

Before we get into the blueprint, let's name the patterns that create pipeline chaos:

Mistake #1: Your ICP is too broad.

You're targeting "B2B SaaS companies" or "mid-market teams." That's not an ICP, it's a category. Without firmographic boundaries (ARR, employee count, tech stack, buying motion), your messaging is generic and your pipeline is full of tire-kickers.

Mistake #2: Your ICP is too narrow.

The inverse problem. You've defined your ideal customer so tightly (e.g., "Series B fintech companies in NYC with 50–75 employees using Salesforce") that your TAM is 200 accounts. Growth stalls because you run out of runway.

Mistake #3: You're chasing enterprise too early.

Enterprise deals look sexy on the board deck. But if you're a $5M ARR company with a 60-day sales cycle trying to close Fortune 500 logos, you're burning quarters waiting for one deal to close. The math doesn't work.

The fix? Build your SaaS go-to-market strategy around a repeatable, mid-market ICP that you can close in 30–45 days, then scale systematically.

The GTM Blueprint: Five Steps to Eliminate Bad-Fit Leads

Step 1: Align Your Teams Around a Single North Star Metric

Sales wants MQLs. Marketing wants traffic. CS wants retention. Everyone is optimizing for different outcomes, and your revenue engine fractures.

The first move is operational alignment: pick one revenue-focused KPI and make it the North Star for every team.

For most companies at your stage, that metric is:

- Net new ARR (if you're land-focused)

- Pipeline velocity (if speed-to-close is the constraint)

- Expansion MRR (if you're PLG or have strong NRR)

Once you align teams around the same number, GTM decisions get simpler. Marketing prioritizes channels that drive pipeline velocity. Sales focuses on accounts that match your win profile. CS identifies expansion signals earlier.

This isn't theory. Companies that unify teams around a single metric see 25–40% improvements in pipeline efficiency within two quarters.

Step 2: Validate Your ICP With Win/Loss Data (Not Assumptions)

Most ICPs are built on gut feel or aspirational buyer personas. That's why they fail.

Here's the process that works:

- Pull closed/won and closed/lost data from the last 12 months.

- Analyze firmographics: company size, ARR, industry, tech stack, buying committee structure.

- Identify deal velocity patterns: which segments close in 30 days vs. 90 days?

- Look at churn and expansion: which customers stay and grow vs. churn in year one?

This grounds your ICP in evidence. You're not guessing, you're sizing your SAM/SOM based on actual win rates and LTV.

The output should be a tiered segmentation model:

- Tier 1 (best fit): closes fast, high LTV, strong retention

- Tier 2 (good fit): longer cycle but still profitable

- Tier 3 (stretch): possible but resource-intensive

Then you build different GTM motions for each tier.

Step 3: Implement AI-Powered Lead Scoring and Routing

Here's a real example: a $10M ARR SaaS company implemented AI lead scoring and segment-based personalized campaigns. Result? 60% increase in pipeline contribution and 35% higher win rates in one year.

Why does this work?

Because AI tools (native in HubSpot, Clearbit, 6sense, etc.) identify buying intent signals before a human ever touches the lead:

- Website behavior (pricing page visits, demo requests, case study downloads)

- Firmographic fit (employee count, tech stack, funding stage)

- Engagement velocity (email opens, content consumption, LinkedIn activity)

You can automate scoring and routing so your SDRs only touch Tier 1 leads, and marketing nurtures Tier 2/3 until they heat up.

This filters bad-fit leads before they consume sales capacity, which is the entire point.

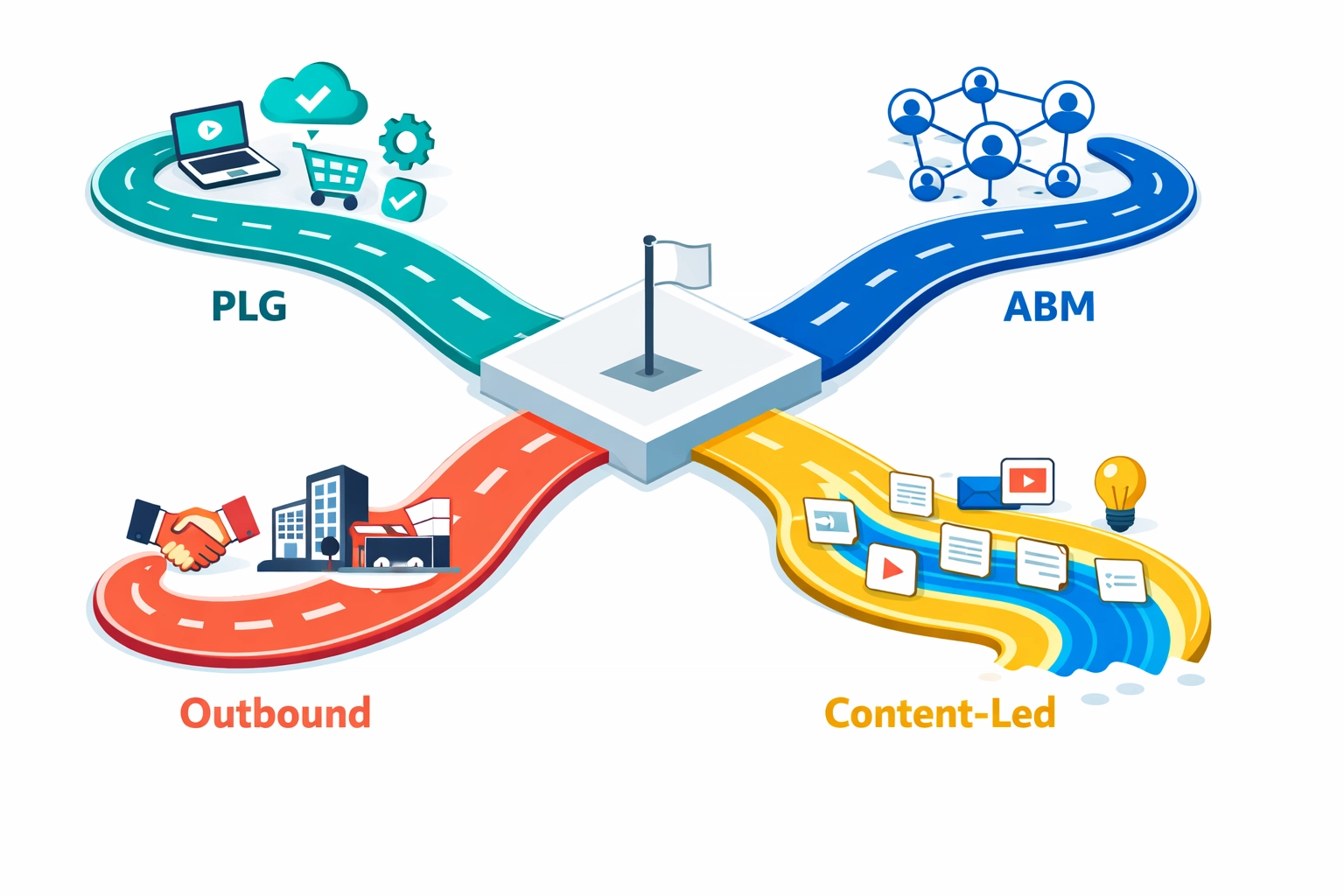

Step 4: Choose the Right GTM Motion by Segment

Not every customer buys the same way. Yet most SaaS companies use one GTM motion (usually "spray and pray outbound") for everyone.

Here's what actually works by segment:

- Product-led growth (PLG): best for $5M-$10M ARR, low ACV (<$10K), self-serve buyers in US/EU

- Account-based marketing (ABM): best for $10M-$25M ARR, mid-market/enterprise deals, committee-based buying

- Outbound + executive events: best for fintech, infrastructure, or regulated industries where trust and authority matter

- Content-led inbound: best for services, consultancies, or emerging markets where education drives demand

The move isn't picking one, it's blending motions by ICP tier. Tier 1 gets ABM + high-touch outbound. Tier 2 gets inbound + nurture sequences. Tier 3 gets content + retargeting.

Step 5: Build Channel-Specific Benchmarks and Kill What Doesn't Work

Most GTM plans fail because there's no feedback loop. You launch campaigns, generate leads, and hope something sticks.

Instead, set channel-specific benchmarks tied to your North Star metric:

| Channel | Benchmark (30 days) | Kill if… |

|---|---|---|

| Paid search | 10+ MQLs, 3+ SQLs | CPA > $500 |

| LinkedIn ads | 5+ MQLs, 1+ SQL | CTR < 0.5% |

| Outbound SDR | 20 connects, 3 meetings | Meeting-to-opp < 20% |

| Content/SEO | 50+ organic sessions | Zero pipeline in 90 days |

Run this audit every 30 days. If a channel isn't contributing to pipeline velocity or net new ARR, cut it. Reallocate budget to what's working.

This is how you move from "doing marketing" to "running a revenue engine."

Tactical Implementation: What to Do This Week

If you're reading this and thinking "okay, but where do I start?": here's the 7-day sprint:

Day 1–2: Pull win/loss data. Identify your Tier 1 ICP.

Day 3: Audit current lead sources. Which channels are driving Tier 1 vs. Tier 3 leads?

Day 4: Set up lead scoring in HubSpot (or your CRM). Route Tier 1 to SDRs immediately.

Day 5: Build one Tier 1 ABM campaign (10–20 accounts, multi-touch sequence).

Day 6: Kill one underperforming channel. Reallocate budget.

Day 7: Align sales and marketing on the same weekly pipeline metric.

You don't need a new tech stack or a rebrand. You need operational clarity and ruthless focus.

The Companies Winning at Your Stage Are Doing This

The SaaS companies seeing 40-60% YoY growth at $1M-$25M ARR aren't the ones with the biggest budgets. They're the ones that:

- Narrowed their ICP to a repeatable customer profile

- Aligned teams around a single revenue metric

- Used AI to filter leads before human touchpoints

- Killed underperforming channels fast

They built a predictable revenue engine, not a hope-based funnel.

And if you want help implementing this blueprint in 90 days: defining your ICP, building lead scoring, aligning GTM motions, and setting up dashboards you can actually trust: that's exactly what our Growth Engine 90 was built for.

We work with SaaS founders at your stage to eliminate bad-fit leads, tighten segmentation, and build a revenue engine that scales without breaking. If that sounds like what you need, let's talk.

Monday EOD Prep Pack for Sonny:

Working Title: Stop Wasting Budget on Bad-Fit Leads: The Proven GTM Blueprint for SaaS Companies ($1M–$25M ARR)

Target Keyword: saas go-to-market strategy

Intended CTA: Growth Engine 90

Key Takeaways (5 bullets):

- Most SaaS companies waste budget on bad-fit leads due to ICP misalignment: too broad, too narrow, or chasing enterprise too early

- Align teams around a single North Star metric (net new ARR, pipeline velocity, or expansion MRR) to eliminate fractured GTM efforts

- Use AI-powered lead scoring to filter bad-fit leads before they consume sales capacity: real results show 60% pipeline growth and 35% higher win rates

- Build different GTM motions by ICP tier (ABM for Tier 1, nurture for Tier 2, content for Tier 3) instead of one-size-fits-all campaigns

- Set channel-specific benchmarks and kill underperforming campaigns every 30 days to reallocate budget to what drives revenue

3 Pull Quotes:

- "You're not generating demand: you're generating noise. Every bad-fit lead that enters your funnel costs you time, money, and forecast accuracy."

- "The SaaS companies seeing 40–60% YoY growth aren't the ones with the biggest budgets. They're the ones that built a predictable revenue engine, not a hope-based funnel."

- "AI tools identify buying intent before a human ever touches the lead. This filters bad-fit leads before they consume sales capacity( which is the entire point.")